Asset Management

Asset Management

Human-Centric

In a world moving more and more towards robo-advisors, Cox Capital offers a more human approach. We use today's tech tools alongside a human element in our process. Unlike the majority of firms our size, we actually meet with many of the companies we invest in.

Finding Gems

We seek out talented and honest companies that are committed to enriching shareholders instead of themselves. We assess whether or not the company has a plan that will lead to success. Do they serve a valuable purpose in society that gives their business a protective moat?

A Risk-Averse Approach

Our risk-averse approach led us to avoid tech companies during the crash of 2000, and to steer clear of big banks in the 2008 financial meltdown. Our investment process rewards the patient, long-term investor. We aim to be wealth managers who are trusted stewards of hard-earned capital.

The Latest Technology

As the world has evolved over the years, so has our investment process. Using the latest technology, we harness big data to refine our risk-management approach. We have designed several proprietary models that serve as key tools in our portfolio management. We believe combining our human approach with the latest quantitative tools gives us an edge.

Fees

| Assets | Fee |

|---|---|

| $0M - $2M | 1.00% |

| $2M - $5M | 0.80% |

| $5M - $15M | 0.60% |

Investment Themes

Artificial Intelligence

AI drives automation and efficiency, creating long-term value in a tech-driven economy.

Infrastructure

Investing in infrastructure supports economic growth through essential developments and upgrades.

Onshoring

Domestic manufacturing boosts supply chain resilience and fosters economic stability.

Energy Transition

Renewable energy investments ensure sustainable growth and long-term cost efficiency.

Digital Transformation

Technology adoption enhances productivity, driving competitiveness in all industries.

Our Strategies

We offer custom portfolios to fit your unique circumstances and preferences, and low-cost mutual fund alternatives to any of the strategies below.

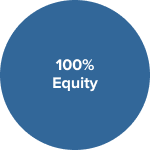

Equity Income

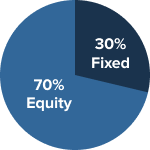

Income & Growth

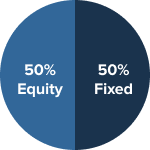

Balanced

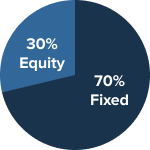

Conservative

Past performance may not be indicative of future returns. No current or prospective client should assume that the future performance of any specific investment or strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. All strategies have different degrees of risk. There is no guarantee that any specific investment or strategy will be suitable or profitable for any investor.

Let's plan your future.

Contact Us